Set to be perhaps the biggest driver in real estate since the early 1980’s, Opportunity Zones present a massive new funding source and that tool now appears primed and ready for real estate developers. Similar in some respects to 1031 exchanges, Opportunity Zones allow investors to defer capital gains from one transaction to the next. Under these new rules, however, investors can defer gains on highly-appreciated assets like stocks and other non-real estate investments.

Zachary Robins, attorney at Messerli & Kramer, thinks big deals will happen soon. “Between March and June 2019, I predict that will be the most active time for these opportunity deals. This will be an exciting time and it’s going to be very productive.” Robins notes the recent changes in advertising will accelerate deals as well. “The new general solicitation rule 506(c) allows for public advertising to maximize the reach of these zones. Not all developments can be named publicly, so this is huge for commercial real estate.” Robins and Duane Lund, CEO of NAI Legacy, are currently involved with the Birdtown Flats in Robbinsdale. “These developments are very exciting, but it’s important to remember that opportunity zones still operate with the same mechanics of real estate, the fundamentals are still in place.”

Lund also speaks highly of this new capital source. “This is one of the most beneficial tax reforms in decades given you can defer the capital gains taxes on non-real estate assets like stock sales and the sale of a business.” Opportunity Zones have been established within Lund’s business already. “Our Opportunity Zone program at NAI Legacy is focused exclusively on ‘last mile distribution, fulfillment and storage’ and with our NAI national footprint, we are one of the few opportunity fund sponsors with boots on the ground in every major US market.”

Established under the 2017 Tax Cuts and Jobs Act, Opportunity Zones were created to spur and encourage investment in low-income communities across the country through tax benefits. A draft of necessary regulations, however, was released on October 19, 2018. At the time of the release of the detailed regulations, there are 128 designated Opportunity Zones in Minnesota for developers and investors to get excited about. Investors in these Opportunity Zones can defer tax from all prior gains using a Qualified Opportunity Fund (QOF), which must be invested into as an entity, treated as a partnership or corporation to qualify for deferral according to the IRS.

Lund adds, “Its estimated that US investors currently hold in excess of $2 trillion in unrealized capital gains. Opportunity Zone funds will allow these investors to deploy some of those gains in a tax deferred vehicle.” As a result, the “Treasury Secretary estimates as much as $100B will be invested in Opportunity Zones across the country.”

Philip Colton, Chair of the Securities and Corporate Finance Practice Group at Winthrop and Weinstine, with thirty-five plus years of experience in Real Estate Funds and REITs, thinks it’s crucial to take action sooner than later. “Like many real estate properties, the first set of deals are likely the best deals. There’s a better chance of a large return. All indicators are that this will allow more flexibility, and many will jump on the bandwagon.” However, many are unclear about the rules around opportunity zones, Colton adds “Businesses are weary to take action until all the rules are out on opportunity zones. People are on the sidelines waiting on the rules, waiting for unanswered questions. If there was more information posted by the treasury that would benefit us all, it needs consistent clarity.”

Opportunity Zones keep their designation for 10 years, and if investors make appropriate investments in that zone and meet requirements, they can defer almost any capital gain until December 2026. Not only are gain deferred, a portion of the gain can be abated all-together. That is, if the QOF investment is held longer than 5 years there is a 10 percent exclusion of the deferred gain. If held for more than 7 years the exclusion jumps to 15 percent.

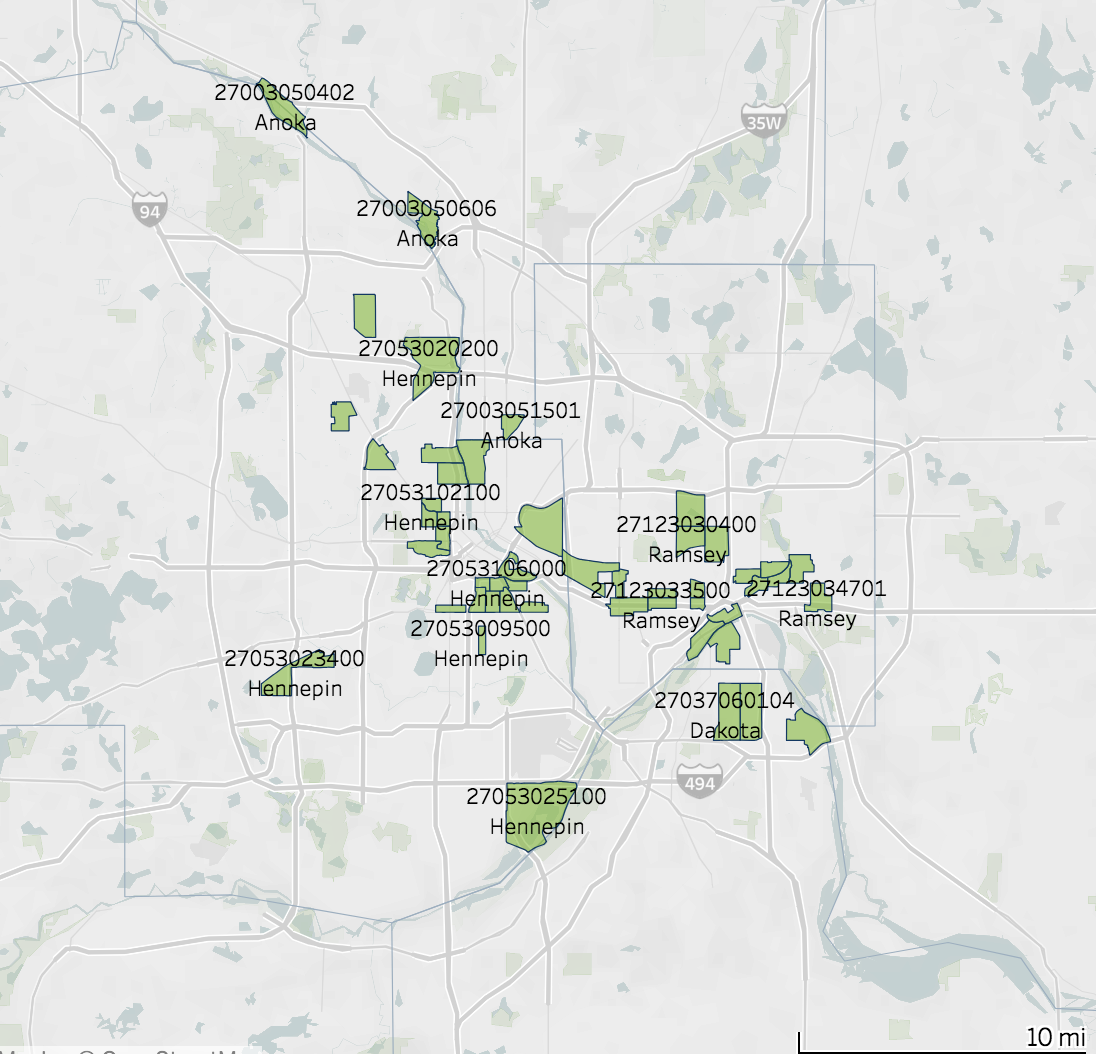

This new program encourages long term growth and economic development in low-income neighborhoods, which could lead to countless local and national partnerships on Opportunity Zone properties. Of the 128 approved low-income census tracts designated for Opportunity Zones in Minnesota, 44 of them are in the Metro area within Hennepin and Ramsey county according to Employment and Economic Development.

John McCarthy, broker with Newmark Knight Frank, has spent a great deal of time researching opportunity zones. He describes them as “a real game changer.” He adds “there is little government involvement,” while still stimulating transactions that will “have a ripple effect in neighborhoods through these opportunity zones.”

The most populated metro areas in the Twin Cities Metro with Opportunity Zones include; Southeast Minneapolis along Como Avenue, South Minneapolis between East Lake Street and Franklin Avenue, and along Wabasha Street North near downtown St. Paul. For investors and developers eager to take advantage of new funding sources or defer gains of their own outside of section 1031 exchanges, Opportunity Zone are going to drive continued development.