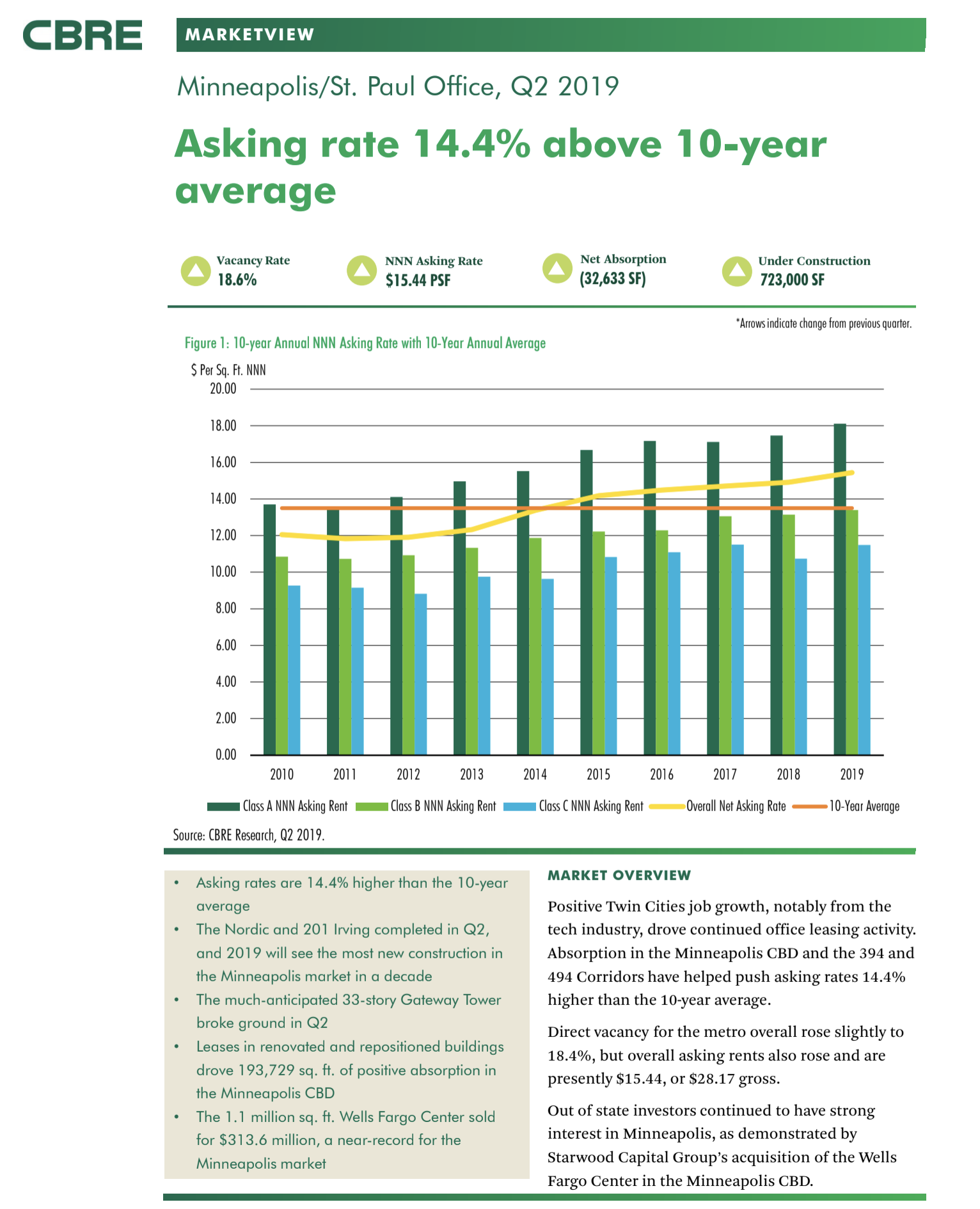

The Minneapolis office market saw asking rates increase to $15.44, 14.4 percent above the 10-year average as demand remains high and job growth continues to surge, particularly in the tech industry, according to a new report by CBRE.

Class A asking rates continue their upward trend, rising to 33 percent above their lowest point in 2011, with the North Loop Class A multi-tenant office market at $22.42-per-square-foot, followed by the I-394 submarket at $19.39-per-square-foot.

“The combination of new buildings and new owners making renovations is driving asking rates higher and tenants are willing to pay,” said CBRE’s Ann Rinde, vice president, advisory and transaction services.

While the overall vacancy rate increased slightly to 18.4 percent, leasing activity remains strong in Minneapolis, with 32,633-square-feet in positive net absorption during Q2. The technology sector was the major driver in the market, accounting for 40 percent of all leasing activity, followed by education at 25 percent.

Continuing the trend from recent quarters, the majority of leases were new rather than renewals, with the Minneapolis CBD accounting for 30 percent of overall leasing activity, followed by the submarkets of I-494 at 24 percent and I-394 at 19 percent.

New construction completions reflected the high demand for creative urban office space, with the Nordic and 201 Irving completions combining for nearly 250,000-square-feet in Q2. All remaining construction scheduled to be completed in 2019 is in the I-394 and North Loop submarkets.

The two largest sales were recorded in Minneapolis CBD, with Starwood Capital Group purchasing the 1.1 million-square-foot Wells Fargo Center and R2 Companies purchasing the 216,609-square-foot Lumber Exchange Building.