Equinix, Inc. (Nasdaq: EQIX) was founded in 1998 during a period that’s been dubbed the internet gold rush. Despite the intervening two-plus decades, Equinix President and CEO Charles Meyers believes that the world is still in the early phases of technological advancement, which bodes well for data center demand.

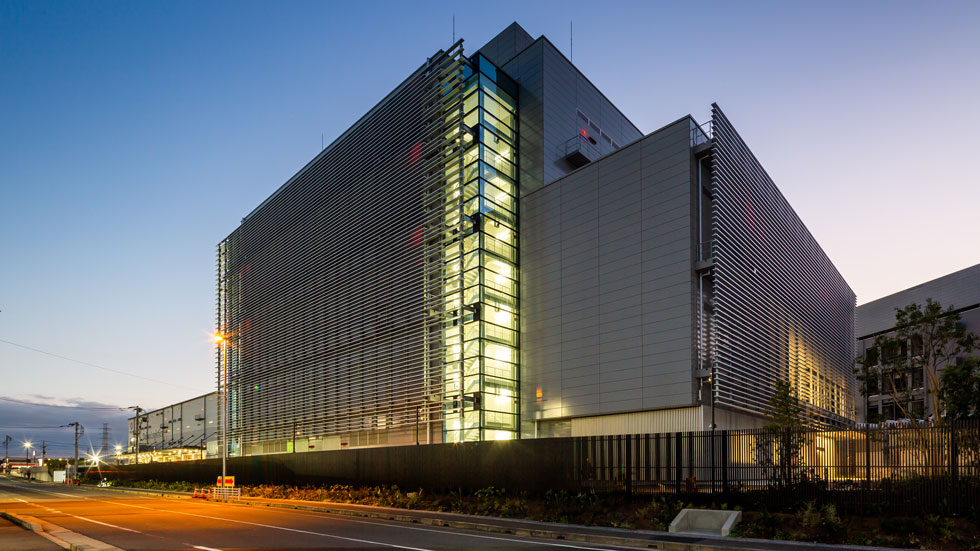

While Equinix may not be a household name, its global network of nearly 230 data centers is a key part of housing the infrastructure of an increasingly digital world. Spanning 26 countries across five continents, Equinix helps companies deliver online services and experiences quickly and securely.

“I often refer to Equinix as the engine room for the digital economy,” Meyers says. “What we do is build, operate, and interconnect data centers where our customers place the digital infrastructure that allows businesses and consumers to accomplish the things we do every day—whether that’s trading stocks on Nasdaq, watching a movie on Netflix, or hosting a Zoom call.”

Based in Redwood City, California, Equinix was founded by Jay Adelson and Al Avery, facilities managers at the former Digital Equipment Corp. The two settled on the name Equinix as a nod to the company’s core attributes: equality, neutrality, and internet exchange.

Colocation Catches On

During the early days of the internet, Equinix developed data centers that gave competing networks and pioneering content providers such as AOL, Microsoft, and Yahoo a neutral place to interconnect. For the first time, they were connecting across rooms—rather than across long distances—which improved data security and reduced latency, or lag time.

The colocation real estate model clearly caught on. Today, thousands of networks exchange internet traffic within Equinix data centers—highly secure, industrial-like facilities that house compute, data storage, and networking equipment.

The company’s tenants include more than 2,900 cloud and information technology (IT) service providers and some 1,800 network service providers, such as Verizon, AT&T, and Cisco. Equinix also has more than 10,000 enterprise customers across a number of sectors, from automotive to financial trading. Equinix’s enterprise customers include more than half of all Fortune 500 companies and a third of the publicly traded firms in the Forbes Global 2000 ranking.

The company charges its tenants for space, power, and cross-connects. In fiscal 2020, its revenues rose by 8% on a year-over-year basis to nearly $6 billion. Equinix also marked its 18th year of consecutive quarterly revenue growth. Total physical and virtual interconnections, or private data exchanges between businesses, surpassed 386,000 in last year’s fourth quarter.

“All of the things in the digital universe that people do every day are made possible by companies being able to put their IT infrastructure where it needs to be and connect it to the right networks,” Meyers says. “A data center without interconnection is just a big refrigerator.”

Global Push

Meyers worked in the tech sector for more than two decades before joining Equinix in 2010 as president of its Americas region. He held several senior leadership positions during a period of rapid growth for Equinix before taking the helm in 2018.

One of his priorities as CEO has been to continue to expand Equinix’s global reach, which allows it to offer one-stop shopping to companies deploying their IT infrastructure across multiple markets. Equinix, for instance, has helped Zoom, the fast-growing, video-collaboration platform, quickly scale its digital footprint at home and abroad. Today, portions of Zoom’s IT infrastructure are housed in Equinix data centers in nine markets.

When Meyers was named CEO, Equinix had data centers in 15 of the world’s 20-largest markets, as measured by gross domestic product. Today, the company has data centers in all but one of them, Russia. Worldwide, Equinix now owns and operates more than 26 million square feet of data center space, the equivalent of 540 football fields end to end.

As CEO, Meyers has overseen forays into Canada, Mexico, India, and South Korea—expansive markets where the data center sector is less mature than it is in the U.S. Last year, for instance, Equinix expanded into India by acquiring the local operations of data center company GPX Global Systems Inc. in an all-cash, $161 million deal.

Thanks to the acquisition, Equinix customers now have access to a network-dense, data center campus in Mumbai, the country’s largest city and a financial hub. Core digital sectors in India, such as IT and digital communications services, are projected to double in size by 2025, contributing as much as $435 billion to domestic economic growth, according to McKinsey.

Equinix plans to use its newly acquired India operations as a platform for further expansion across the country—replicating a strategy it has used in other foreign markets, where developing data centers without local know-how and boots on the ground can be a fraught endeavor.

“If you’re a multinational corporation, you want to have your IT network connected in the simplest way possible. But it’s really challenging to lease data center space from multiple companies across the globe,” says Green Street analyst David Guarino.

“Equinix has expanded its footprint across the globe and found a way to connect their data centers. So, if you’re Coca-Cola, for example, and you want to connect through data centers in the U.S., Latin America, Europe, and Asia, Equinix can do that on its platform— securely and with a low-latency experience,” Guarino says.

A Different DNA

Under Meyers, the company has not only expanded its global reach, but continued to enhance products and services to meet the evolving needs of customers. For instance, Equinix recently developed a software-defined platform, called Fabric, that allows enterprise IT customers to buy interconnections remotely and in real time—a move that reflects changing customer expectations in an on-demand world.

“Equinix is very focused on the connectivity side of the business, along with leasing out data center space to tenants,” Guarino says.

Meyers says the digital transformation of companies will continue to fuel strong demand for data center space—and he’s not alone in that view. The sector’s resilience during the pandemic and its demand outlook have piqued the interest of a number of deep-pocketed private investors. A flood of capital coming into the space is expected to boost supply and mergers and acquisitions activity.

“A lot of capital is going into expanding or purchasing smaller platforms, growing bigger ones, and creating new platforms from scratch. In the private market, infrastructure funds, sovereign wealth funds, and pension funds are all quite active,” says RBC Capital Markets analyst Jonathan Atkin.

Hyperscale Focus

Equinix is hardly resting on its laurels. Meyers expects to see further segmentation of the data center market with growth concentrated in two areas: its existing product type (network-dense, co-location centers) and centers designed to meet the deployment needs of so-called hyperscale customers like Google Cloud, AWS, and Microsoft Azure as they build out their public cloud services. That’s why Equinix recently accelerated its commitment to the hyperscale market through a $3 billion joint venture with GIC, Singapore’s sovereign wealth fund.

Equinix contributed 80% of the joint venture’s equity capital, and GIC contributed the balance. The joint venture, Meyers says, will also raise capital in the debt market to finance its projects. Earlier this year, Equinix opened its first two xScale data centers in Japan and France and has projects underway in several other markets.

A hyperscale data center, which may span several hundred thousand square feet, is a type of wholesale product, typically occupied by no more than a few tenants. Hyperscale facilities tend to consume more power on a per-square foot basis than other types of data centers, which is why they’re often located farther away from urban centers, where it is relatively cheap.

“What the joint venture allows us to do is expand aggressively in the hyperscale space without using all of our balance sheet in that area because we really want to preserve our balance sheet for the more retail-oriented side of the business,” Meyers says. “I think Equinix is really well-positioned in both of these spaces,” he adds.

Flocking to the Cloud

Many businesses use cloud technology—either entirely or partially—to store and access data and programs over the internet for reasons that include security, convenience, reliability, performance, and cost.

“There are a couple things that are increasingly true about how people think about their IT infrastructure: it’s more heavily distributed, meaning it has to go out closer to end users, and it’s increasingly cloud-connected,” Meyers says.