By Herb Tousley

Director of Real Estate Programs hwtousley1@stthomas.edu

What is an accessory dwelling unit (ADU)? An accessory dwelling unit is a simple and old idea, having a second small dwelling on the same grounds (or attached to) a regular single-family house. According to code, ADUs can be attached to homes as mother-in-law units, detached as cottage houses, in yards as garage apartments or inside the main residence such as a basement or attic apartment. All must have plumbing, electricity and basic amenities for living, as well as their own entrances. In Minneapolis, ADUs must be at least 300-square feet and owners of the main residence must live on the property. In some areas ADUs might be a solution to increasing density and increasing affordability while making a gradual change to a neighborhood without changing its character and without creating substantial parking or traffic issues. Both Minneapolis, St Paul and many suburbs have adopted some type of zoning that allow ADUs.

There are several challenges that are holding back the development more ADU units.

First, for many homeowners financing is often the greatest challenge they face in trying to build an ADU. That’s because the upfront cost or down payment can be prohibitive and at this point there are not many financial options specifically suited for this type of development.

The second is cost; construction costs and entitlement fees are at all-time highs. A recent article on MINNPOST states that according to local architects and experts in housing trends, ADU structures’ high cost of construction, which can range between $140,000 and $320,000 in Minneapolis, and building requirements can deter people from adding this new type of development

Finally, there will have to be some clarification of ownership issues and renters’ rights. As an example, what happens if the property is sold with a renter in an ADU? If the renter has a lease does the new owner have the right to terminate it? An additional consideration is whether the city you are located in requires a rental license,

Sarah Berke, a program officer at the Family Housing Fund, said “accessory dwelling units aren’t as common in the Twin Cities as they are in other places. The potential for ADU development in the metro is still, I would say, largely untapped.”.

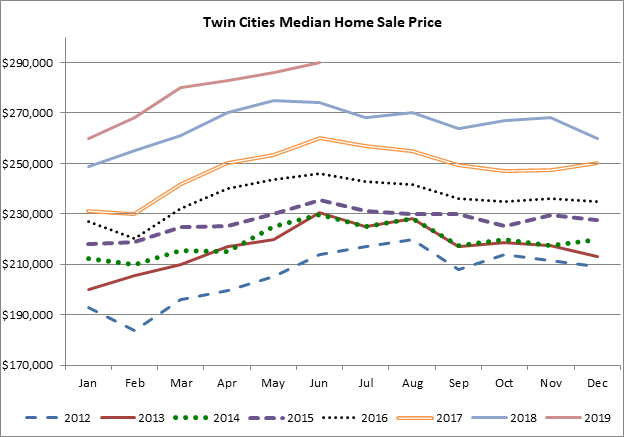

June Market Update

Despite some concerns that the Twin Cities is starting to cool down the current data shows that it is still very much a sellers’ market. The median sale price in the Twin Cities touched $290,000 this month, setting yet another all-time high. (See the Chart Below) In June there was a 2.5 months supply of homes for sale. In contrast, normally there is a 4 – 6-month supply. The number of homes for sale at 12,112 was essentially the same as the 12,222 recorded in June 2018. The low number of homes for sale continues to exert downward pressure on the number of closed sales recorded at 6,619 down 8% compared to a year ago. The shortage is particularly acute with homes priced under $260,000 where the months supply is less than 1 ½%. Pending sales was 6,324 down 2.6% compared to June 2018. New listings at 8,473 in June 2019 were 3.1% lower than one year ago.